Client funds management is the process of tracking client funds received in those accounts separately from your law firm's operating funds. If your firm accepts client funds, there are industry rules that you need to follow when managing these funds in order to remain compliant. Clio can help you do everything from creating and retaining client funds to using client funds to pay client invoices and refunding or disbursing funds in accordance with industry rules. Learn more about Client Funds Account Compliance.

Tip: When applying payments to client funds requests, you can either manually record payments on transactions or accept credit card, debit card, Apple Pay, Google Pay, or Pay by Banks payments that deposit funds directly into client funds accounts using Clio Payments. Learn more about signing up for Clio Payments here.

Create client funds accounts

Before creating a client funds request and accepting payment, you will need to create a client funds account in Clio Manage where the paid client funds will be stored.

To create a client funds account in Clio Manage, follow the steps to create a new account and select Client Funds Account for the Account type. If you have Clio Payments enabled, you can also connect the account to online payments to accept credit card and eCheck payments.

Create client funds requests

In Clio Manage, you can create client funds requests to collect initial client funds deposits or retainers from your clients or to add more client funds if the client funds reach a minimum threshold. Client funds requests do not include any time or expense activities. You can create a client funds request from the contact's Dashboard, matter's Dashboard, the main Billing tab, or the global Create new menu.

- Go to the contact and select the Dashboard subtab.

- Click New client funds request in the upper right corner.

- Complete the client funds request details.

- Optional: Check the box for Skip the client funds approval process to send the client funds request directly to a client without requiring approval from another firm member.

- Click Save client funds request.

- Go to the matter and select the Dashboard subtab.

- In the Financial card, under Client funds, click New request.

- Complete the client funds request details.

- Optional: Check the box for Skip the client funds approval process to send the client funds request directly to a client without requiring approval from another firm member.

- Click Save client funds request.

- Go to the main Billing tab.

- Click the down arrow next to New bills and select New client funds request.

- Complete the client funds request details.

- Optional: Check the box for Skip the client funds approval process to send the client funds request directly to a client without requiring approval from another firm member.

- Click Save client funds request.

- Click the global Create new menu and select Client funds request.

- Complete the client funds request details.

- Optional: Check the box for Skip the client funds approval process to send the client funds request directly to a client without requiring approval from another firm member.

- Click Save client funds request.

Protect client funds

Managing client funds comes with numerous industry rules. Your firm may need to have strict control over client funds for various reasons, such as covering counsel fees, undertakings, expenses, or future invoices. In Clio Manage, you can protect specific client fund amounts for future use. Protected funds will be reduced from the overall matter funds balance and will only be available for future fees and expenses.

Step 1: Enable the protected funds setting

Before getting started with protected client funds, an administrator on the firm account needs to enable the setting.

- Go to Settings > Billing.

- Select Protected funds.

- In the Protected matter funds section, turn the toggle to the on position.

Step 2: Add and manage protected funds

- If you have Accounts permissions, you can add, edit, or delete protected funds, or apply protected funds to invoices.

- If you do not have Accounts permissions, you can view protected funds, increase the amount of existing protected funds, and send a request to a user with Accounts permissions to release protected funds back to the client or to pay an invoice.

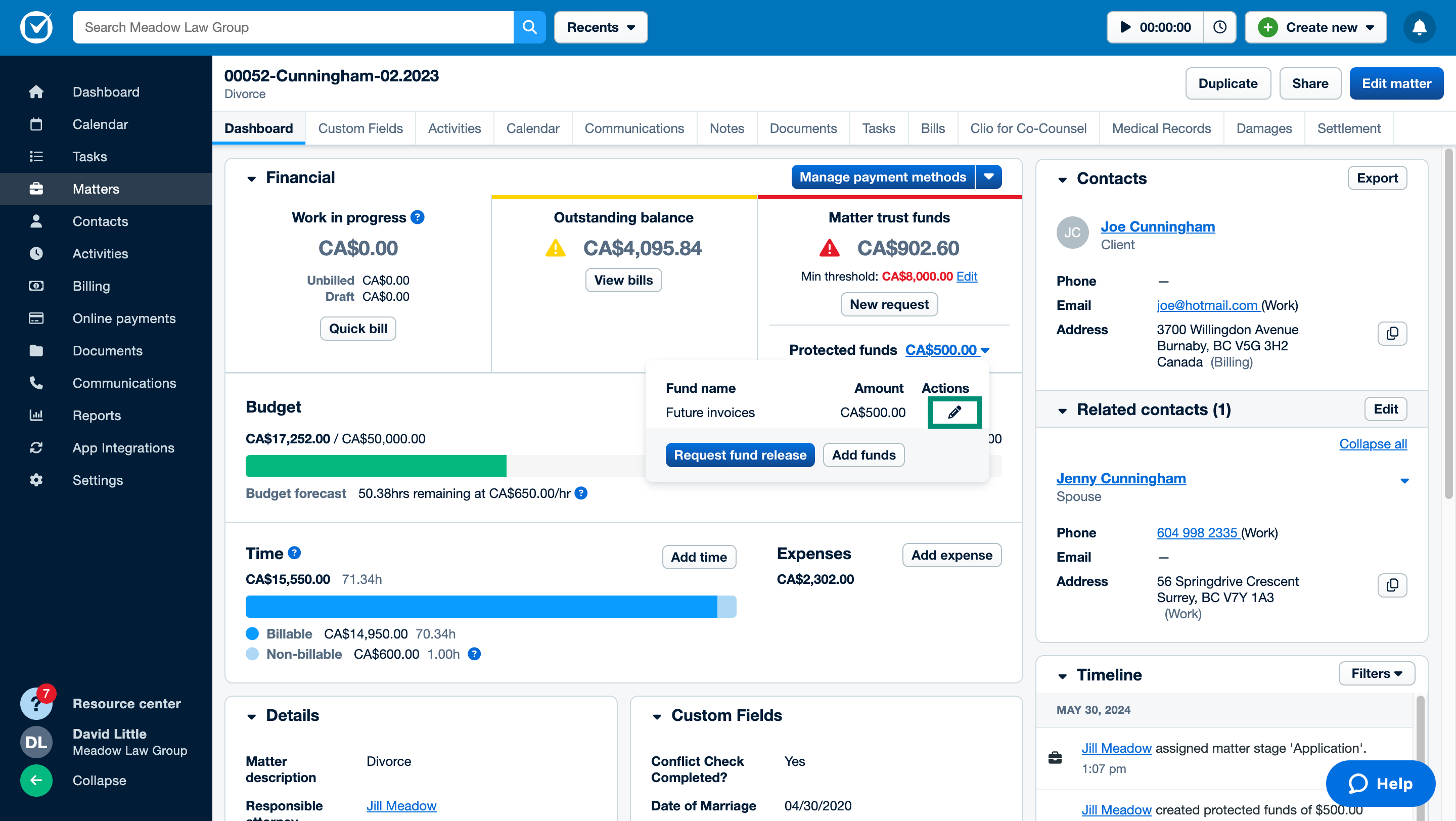

If you have Accounts permissions, you can add, edit, or delete protected funds from a matter's Dashboard. Once added, you can apply protected funds to an invoice from the main Billing tab or the Bills subtab in a contact or matter. Any changes made to protected funds will be recorded in the matter's Timeline. The record will show which user made the change with a date and time stamp.

- Go to a matter.

- In the Dashboard subtab, open the Financial section and go to the Available client funds box.

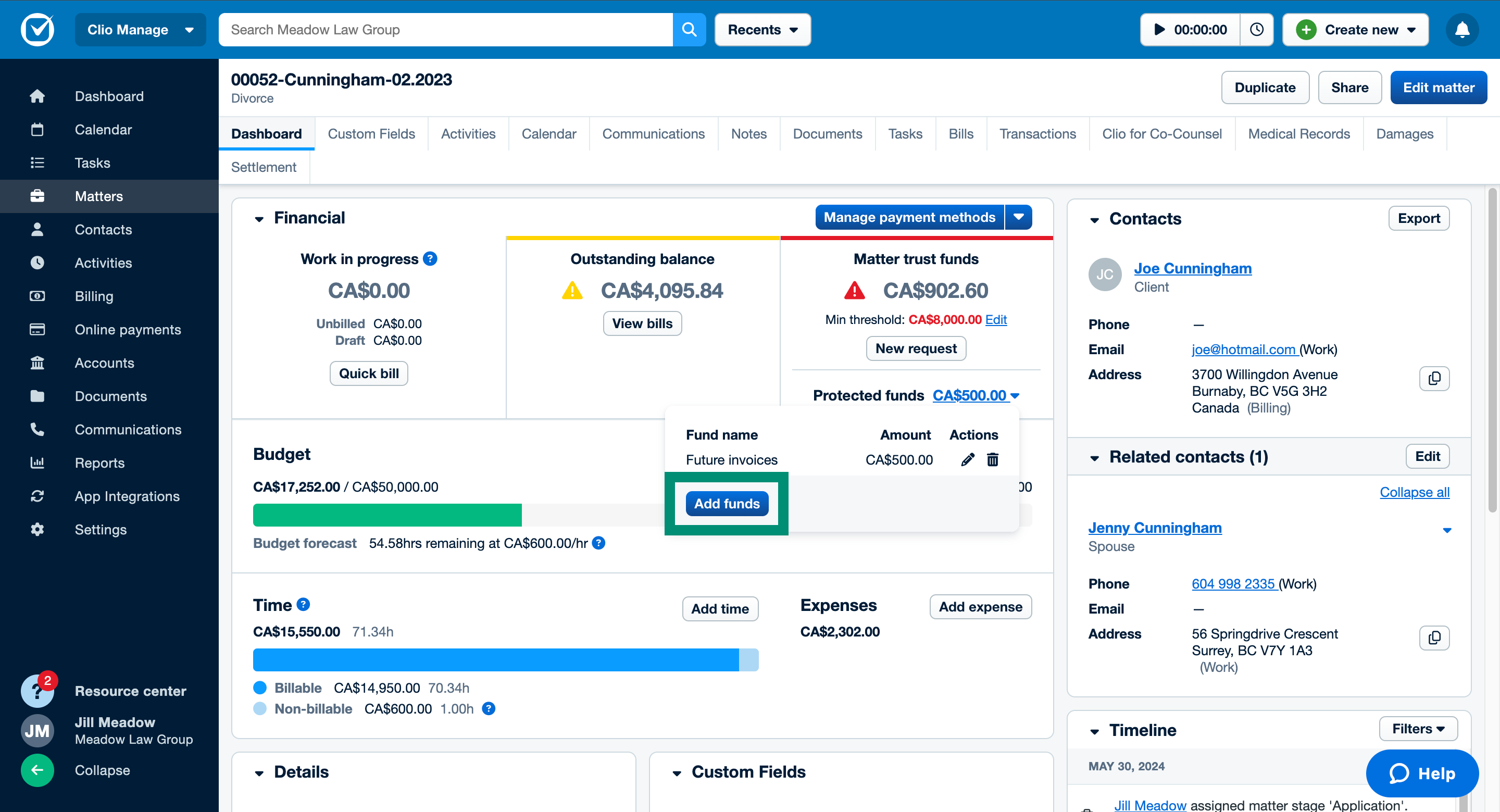

- If this is the first time you are protecting funds for this matter, click Add next to Protected funds. If you have already added protected funds to this matter, click the protected funds total and then click Add funds.

- Enter the amount you want to protect and the reason you want to protect the funds. If the client has multiple client fund accounts, select the relevant account.

- Click Add.

- The amount of the client funds that you protected will be subtracted from the total amount of available client funds on the matter. You can view the protected funds by clicking the amount of the protected funds in the Available client funds box.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Available client funds box, click the protected funds total next to Protected funds.

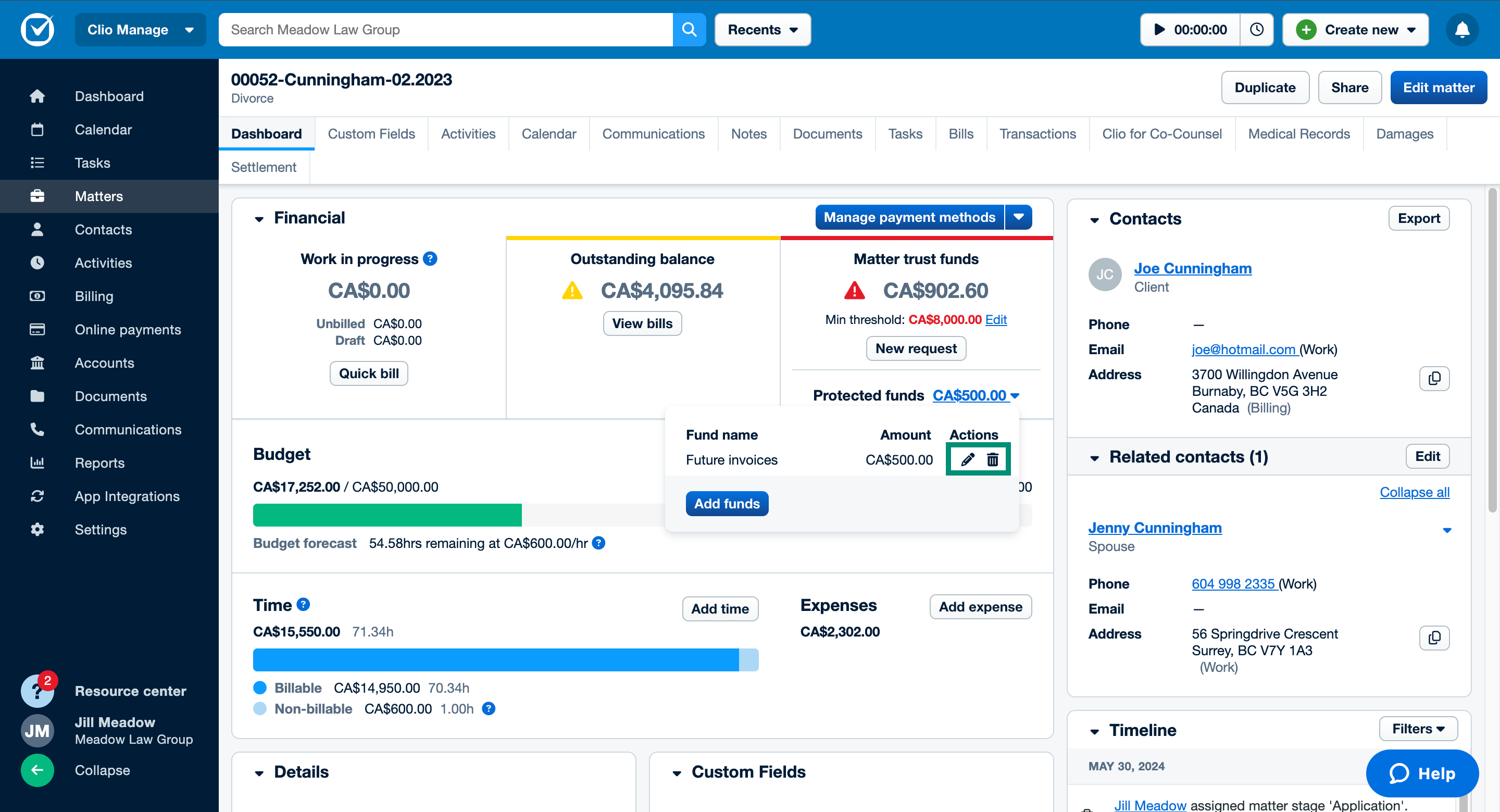

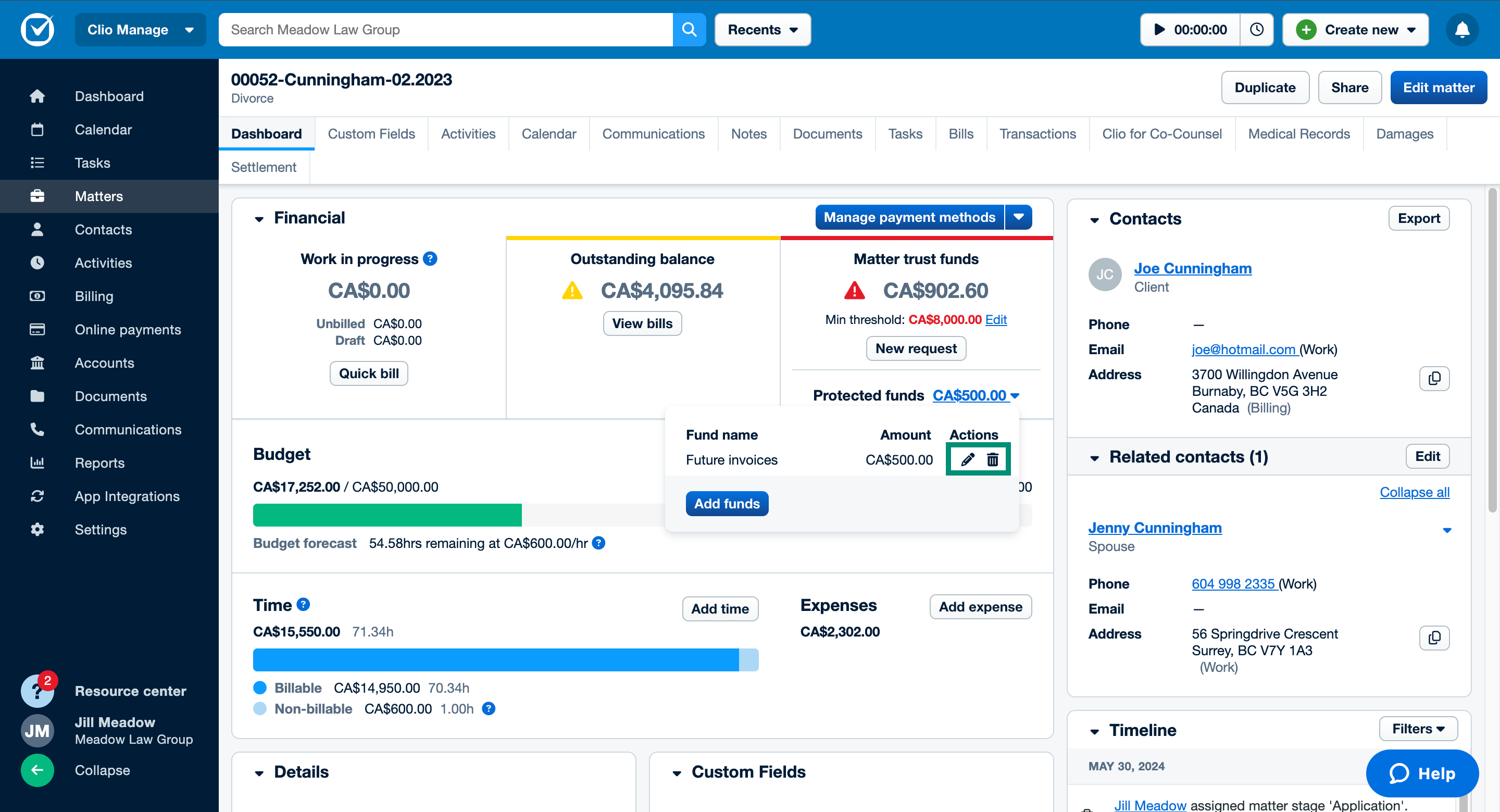

- Click the pencil icon representing Edit to edit a protected fund.

- Make any changes to the amount or reason and then click Save changes.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Available client funds box, click the protected funds total next to Protected funds.

- Click the trash can icon representing Delete to unprotect a fund.

- Click Delete to confirm.

- Go to the main Billing tab or the Bills subtab in a contact or matter.

- Find the invoice that you want to apply the protected funds to. You can use the quick filters to find invoices that have not been paid yet or the keyword search box.

- Click the down arrow next to Send and then select Apply protected funds.

- Select the account that the protect funds will go into and the protected fund that you want to use to pay the invoice.

- If the client only has one protected fund, the selection will be locked in and cannot be changed since there are no other protected funds.

- Click Apply funds.

If you do not have Accounts permissions, you cannot add protected funds, but you can view all protected funds for a matter, edit the reason for currently protected funds, and increase the amount of the protected fund. Any changes made to protected funds will be recorded in the matter's Timeline. The record will show which user made the change with a date and time stamp.

You can also send a request to users with Accounts permissions to release protected funds back to the client or request that protected funds be used to pay an invoice. Once you send the request, all users with Accounts permissions will receive an email about your request.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

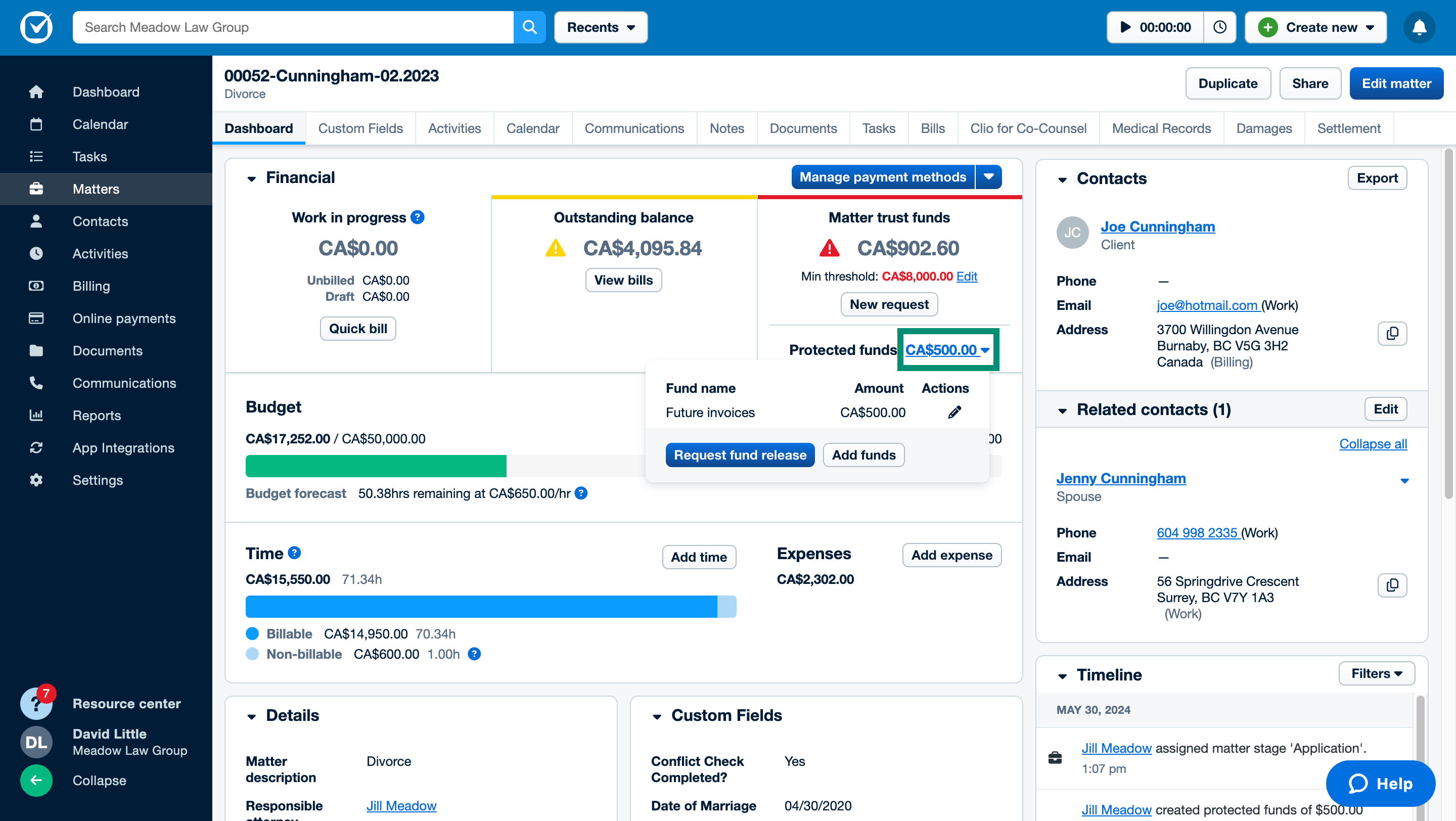

- In the Available client funds box, click the protected funds total next to Protected funds to view all protected funds for the matter.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Available client funds box, click the protected funds total next to Protected funds.

- Click the pencil icon representing Edit to edit a protected fund.

- Increase the amount or change the reason and then click Save changes.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Available client funds box, click the protected funds total next to Protected funds.

- Click Request fund release.

- Select the protected fund and the reason for requesting the release.

- Under Reason, select Release back to the client or Pay an invoice. If you selected Pay an invoice, you will also need to select the invoice that should be paid.

- Optional: Enter a memo to add more details about the release request.

- Click Request fund release.

Sort and filter client funds requests

Once a client funds request is created, you can find it in the Billing tab or the Bills subtab within a matter or contact. The client funds request is differentiated from normal bills when viewing the bill ID. The bill ID will have the word "Client Funds" written in parentheses next to the bill ID number. To view only client funds requests:

- Go to Billing.

- Select the All subtab.

- Click Filters.

- Optional: select the matter or contact.

- Under Type, select Client Funds.

- Click Apply filters.

Edit client funds requests

You can only edit a client funds request if it is in draft and the client funds approval process has not been skipped. Generated client funds requests in draft have limited edit functionality compared to generated bills in draft. To edit a generated client funds request:

- Go to Billing or the Bills tab in a contact or matter.

- Click the Draft subtab.

- Click Edit.

- Make your changes.

- Click Save client funds request.

Approve client funds requests

When a client funds request is created and you do not check the box to skip the client funds approval process, the client funds request can be found in the Draft subtab in Billing. While in draft, you can edit the client funds request and send it for approval, and approve the client funds request. Once approved, you can accept payment for the client funds request.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Draft subtab.

- Click the down arrow next to Edit and select Submit for approval.

- Select the firm member(s) who need to approve the client funds request.

- Click Submit for approval.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Pending approval subtab.

- Click the down arrow next to Edit and select Approve client funds request.

Send client funds requests

Once a client funds request is approved, you can send it to the client. You can also send the client funds request to other related contacts.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Unpaid subtab.

- Click Send.

- Select the client funds bill template, make any changes, and select the send method. Learn more about sending bills and bill options.

- Click Send client funds request.

Delete client funds requests

If a client funds request is still in draft, you can still delete the request. A client funds request that has been approved but does not have a recorded payment can only be voided.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Draft subtab.

- Click the down arrow next to Edit and select Delete client funds request. Alternatively, you can view the client funds request, click the More actions dropdown, and select Delete.

- When the warning prompt appears, click Delete client funds request.

Void client funds requests

Follow these steps to void an approved and unpaid client funds request:

- Go to Billing or the Bills tab in a contact or matter.

- Click the Pending approval subtab.

- Click the down arrow next to Edit and select Void client funds request. Alternatively, you can view the client funds request, click the More actions dropdown, and select Void.

- When the warning prompt appears, click Void client funds request.

Record payments on client funds requests

If you do not have Clio Payments enabled, or if your client does not want to pay by debit or credit card online, you can record payment towards a client funds request. Due to regulations for client fund management, you will be unable to edit or delete a payment recorded for a client fund request.

Follow the steps below to record a payment using client funds.

- Go to Billing or the Bills tab in a contact or matter.

- Optional: Select the Unpaid subtab.

- Click the down arrow next to Send and click Record payment. You can also click Record payment in the upper right corner.

-

Select the payment source and select the client funds account as the deposit account.

Note: If your client previously paid client funds into a client fund account, and those funds are not associated with a specific client funds request, you can use those funds to record a payment to the current client funds request by selecting the account from the Payment source dropdown. A table will show the amounts available in the selected client funds account. - Complete the remaining details.

- Note: You can write off a remaining client funds amount while recording a partial payment towards the client fund request by first entering the partial amount, then checking the check box for Write offs.

- Click Record payment.

Record new transactions/receipts

If you need to record a new client funds and need to record the client funds transaction, you can do so from within the contact or matter's Transactions subtabs or from the main Accounts tab. You can record this transaction/receipt of funds even if you did not create a client funds request. The process for recording a new transaction in a client funds account will look a little different depending on whether or not you have enhanced client funds account features enabled. Once an entry has been recorded, each transaction will automatically be assigned a receipt number under the Transactions column of the receipts table.

- Go to a contact or matter and click the Transactions subtab.

- For the account dropdown, select the appropriate client funds account that the funds are being deposited into.

- Click New receipt or New transaction.

- The name of the button will be determined by whether you have enhanced client funds account features enabled or not.

-

Complete the required information.

Important: If you select Cash or Cheque under Payment Type, you are also required to create a client funds deposit record. Learn more about creating client funds deposit records below. - Click Record transaction.

- Go to Accounts and select the appropriate client funds account that the funds are being deposited into.

- Click New receipt or New transaction.

- The name of the button will be determined by whether you have enhanced client funds account features enabled or not.

- Complete the required information.

- Click Record transaction.

Send, view, and download client funds transactions/receipts

You can view or download any recorded client funds transaction/receipt. You can also send an email of the receipt to your client.

- Go to Accounts.

- Select the client funds account where the funds are held.

- Select either the Transactions subtab or the Receipts subtab.

- Find the client funds receipt record that you want to view.

- Send, view, or download the transaction/receipt.

- Send: Click Send, choose the client and send method, then click Send receipt.

- View: Click the down arrow next to Send and select View.

- Download: Click the down arrow next to Send and select Download to download a PDF copy to your computer. You can also download the receipt while viewing it.

Create, view, and download client funds deposits

When you receive client account funds in the form of a cheque or cash, UK compliance rules require that you create a deposit record at the time that you receive these funds. Clio helps you to stay compliant by allowing you to create a deposit record quickly with all the information that is required to ensure compliance and a proper audit trail. You will be required to provide a copy of this record to your banking institution at the time that you physically deposit the funds into your (client funds) account, so Clio also makes it easy for you to download this record from Clio.

- Go to Accounts.

- Select the client funds account where the funds will be allocated.

- Select Deposit funds.

- From the list of undeposited transactions, select the transactions that you want to deposit.

- Enter the Deposit reference and select the Bank account and Deposit date.

- If you are depositing any cash deposits, enter the dollar values under Coins and Notes for the amount of cash coins and cash bills.

- Under Transactions, select the cash and/or cheque deposits that you want to deposit.

- Click Save deposit.

- Go to Accounts.

- Select the client funds account where you recorded the client funds receipt.

- Select the Transactions subtab.

- Find the client funds deposit record that you want to view.

- Click the down arrow next to Edit and select View to view the client funds deposit record, or click Download to download a PDF copy for your banking institution.

Transfer client funds

If you store client funds at the client level, they can be applied as payment on bills for any of the client's matters. When these funds are recorded, a transaction is added to the client's ledger, which can be found in the Transactions subtab of the contact card. When paying bills with client funds, the matter-level client funds are available to use as payment on that specific matter only. When these funds are recorded, a transaction is added to both the client and matter ledgers, which can be found in the Transactions subtab of the contact card or matter screen.

- Go to the Transactions subtab of a contact.

- Select the client account where funds are stored.

- Click Transfer funds.

- Select Between matters.

- Under Source, select Client Balance.

- Under Destination, select a matter.

- Complete the remaining fund transfer details.

- Click Record transfer.

- Go to the Transactions subtab of a matter.

- Select the client account where funds are stored.

- Click Transfer funds.

- Select Between matters.

- Under Source, select a matter with a Matter Balance.

- Under Destination, select Client Balance.

- Complete the remaining fund transfer details.

- Click Record transfer.

Release client funds

You can release any remaining client funds back to the client or adjust mistakenly applied client funds.

- Go to the matter or contact, depending on where the client funds are stored.

- Click the Transactions subtab.

- In the Transactions table window, use the down arrow to select the client funds account.

- Click Release funds (if enhanced client funds accounting is not enabled) or New payment (if enhanced client funds accounting is enabled).

- Enter the information about where the funds are being released from (including the account, amount, date, and description or relevant reference number) and where the funds are being released to (which may include the method of payment, destination account detail(s), recipient name, the associated matter and client and/or description or relevant references number).

- Click Record transaction.

Pay from client funds accounts and view transactions

You can use funds held in client funds accounts to pay bills and cover third-party expenses related to a matter. You can pay third-party bills from client funds accounts by recording a client funds payment directly to the third party or by recording the expense in Clio, generating a bill, and then applying client funds to the bill. Once the transaction is recorded, you can view its details from the client funds account. Each transaction will have its own automatic receipt number under the Transactions column of the receipts table.

- Go to Accounts.

- Select the client funds account from which you will make the payment.

- Click New payment.

- When you select a matter, the matter's client funds balance will be provided. If the account does not have sufficient funds, you will see a warning that the account will be overdrawn. If you proceed with the payment, the client's account will go into an overdrawn state. You can report on overdrawn accounts using the client funds overdrawn report.Complete the required fields, including the payment type, recipient, the client and matter from which the funds will be withdrawn, and the description.

- Click Record transaction.

You can apply client funds to any generated bill with activities.

- Find a bill in an unpaid state. You can go to the main Billing tab and select the Unpaid subtab. You can also see unpaid bills for a matter by viewing a matter, then clicking the Bills subtab and selecting the Unpaid quickfilter.

- For the unpaid click the down arrow next to Send and select Record payment.

- Under Payment source, choose the client funds account from which the funds will be taken.

- Under Deposit Account, select the operating account into which the funds will be deposited.

- Complete the remaining fields and then click Record payment.

- The paid invoice will appear in the client funds and operating account.

To view your client funds transactions:

- Go to Accounts.

- Select the client funds account where you recorded the payment.

- Select the Transactions subtab.

- Find the transaction record that you want to view.

- Click the down arrow next to Edit and select View to view the payment transaction.

Void cheque payments

In order to comply with client account compliance rules, you are required to record all cheques. If a cheque is damaged and you need to void it, you can record a transaction of the voided cheque.

- Go to Accounts and select the appropriate client funds account.

- Click New payment.

- Under Payment type, select Cheque and add the reference number for the damaged cheque.

- Select the box next to Void Cheque.

- Under Reason, enter the reason why you are voiding the cheque.

- Click Record transaction.