Trust account management involves tracking client funds given in trust separately from your law firm's operating account. If your firm accepts client trust funds, you must follow industry rules when managing these funds to remain compliant. Clio can help you do everything from creating and retaining trust funds to using trust funds to pay client invoices and refunding or disbursing funds per industry rules.

Tip: When applying payments to trust requests, you can manually record payments on transactions or accept credit card, debit card, Apple Pay, or Google Pay payments that deposit funds directly into trust accounts using Clio Payments. Learn more about signing up for Clio Payments here.

Create trust accounts

Before creating a trust request and accepting payment, you will need to create a trust account in Clio Manage where the paid trust funds will be stored.

To create a trust account in Clio Manage, follow the steps to create a new account and select Trust Account for the Account type. If you have Clio Payments enabled, you can also connect the account to online payments to accept credit card and eCheck payments.

Create trust requests

In Clio Manage, you can create trust requests to collect initial trust deposits or retainers from your clients, or to add more trust funds to a matter if the trust funds reach a minimum threshold. Trust requests do not include any time or expense activities. You can create a trust request from the contact and matter Dashboard, the main Billing tab, or the global Create new menu.

Note: Trust funds can be stored at the client or matter level. You can select where to store these funds when creating the trust fund request. If you use multiple currencies at your firm, the currency of a trust fund request will be inherited from the billing preferences set for the matter (when storing funds at the matter level) or the client (when storing funds at the client level). You can also transfer funds from the client level to the matter level. Learn more about transferring funds below.

- Go to the contact and select the Dashboard subtab.

- Click New trust request in the upper right corner.

- Complete the trust request details.

- Optional: Check the box for Skip the trust approval process. If you check this box, you can send the trust request directly to a client without requiring approval from another firm member.

- Click Save trust request.

- Go to the matter and select the Dashboard subtab.

- In the Financial card, under Matter trust funds, click New request.

- Complete the trust request details.

- Optional: Check the box for Skip the trust approval process. If you check this box, you can send the trust request directly to a client without requiring approval from another firm member.

- Click Save trust request.

- Go to the main Billing tab.

- Click the down arrow next to New bills and select New trust request.

- Complete the trust request details.

- Optional: Check the box for Skip the trust approval process. If you check this box, you can send the trust request directly to a client without requiring approval from another firm member.

- Click Save trust request.

- Click the global Create new menu in the Clio Manage header and select Trust request.

- Complete the trust request details.

- Optional: Check the box for Skip the trust approval process. If you check this box, you can send the trust request directly to a client without requiring approval from another firm member.

- Click Save trust request.

Protect client trust funds

Managing trust funds comes with numerous industry rules. Your firm may need to have strict control over trust funds for various reasons, such as covering counsel fees, undertakings, expenses, or future invoices. In Clio Manage, you can protect specific client fund amounts for future use. Protected funds will be reduced from the overall matter funds balance and only available for future fees and expenses.

Note: Only administrators can enable the protected trust funds setting. Once enabled, users with Accounts permissions can add, edit, or delete protected funds, or apply protected funds to invoices. Other firm users can view protected funds, make edits, and send requests to users with Accounts permissions to release protected funds.

Step 1: Enable the protected funds setting

Before getting started with protected trust funds, an administrator on the firm account needs to enable the setting.

- Go to Settings > Billing.

- Select Protected funds.

- In the Protected matter funds section, turn the toggle to the on position.

Step 2: Add and manage protected funds

- If you have Accounts permissions, you can add, edit, or delete protected funds, or apply protected funds to invoices.

- If you do not have Accounts permissions, you can view protected funds, increase the amount of existing protected funds, and send a request to a user with Accounts permissions to release protected funds back to the client or to pay an invoice.

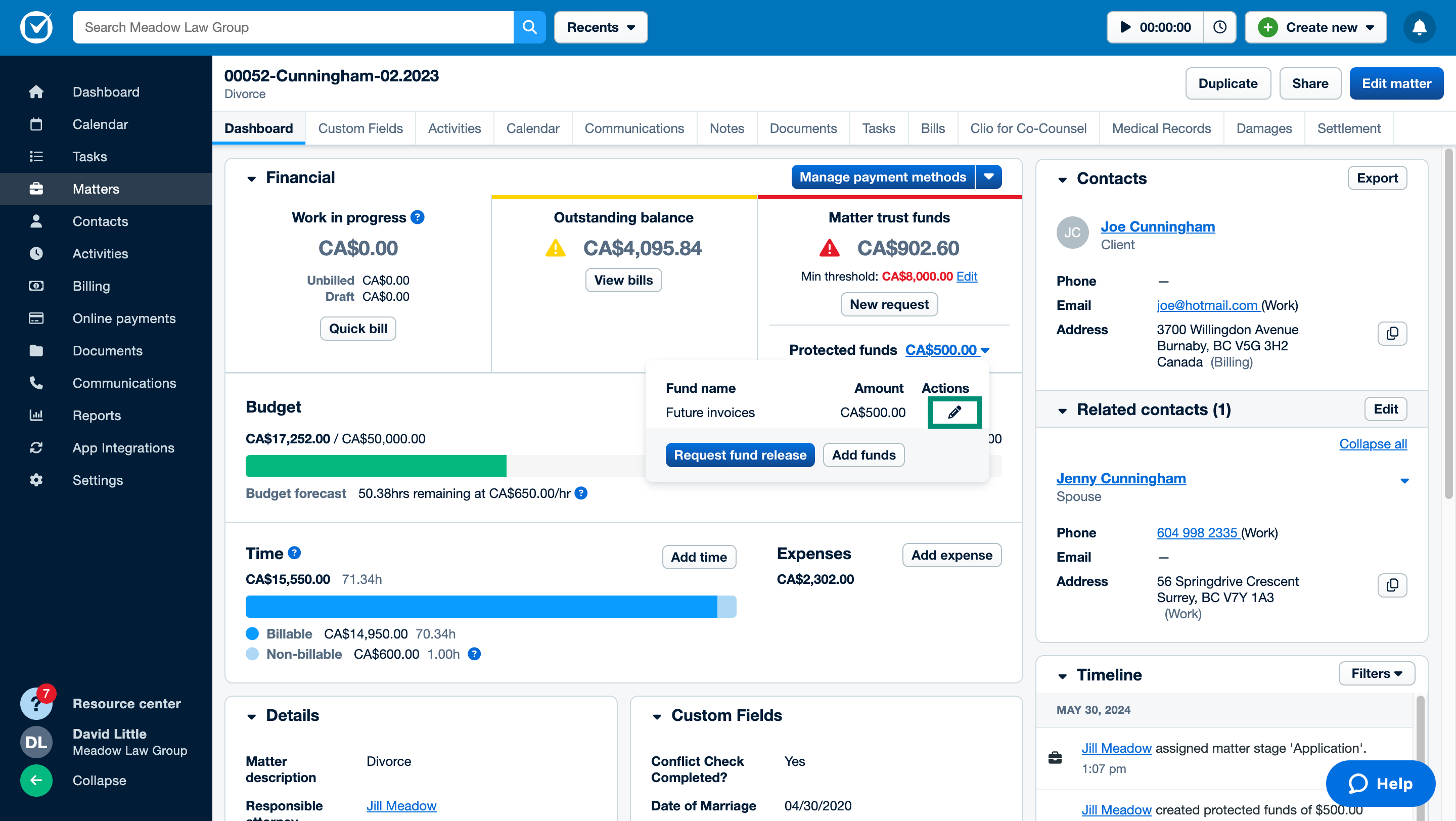

If you have Accounts permissions, you can add, edit, or delete protected funds from a matter's Dashboard. Once added, you dashboard, or you can apply protected funds to an invoice from the main Billing tab or the Bills subtab in a contact or matter. Any changes made to protected funds will be recorded in the matter's Timeline, and the matter's record will show which user made the change with a date and time stamp.

Note: You can only protect funds if your client has available trust funds to protect. You can add trust funds by creating a trust request and recording a payment.

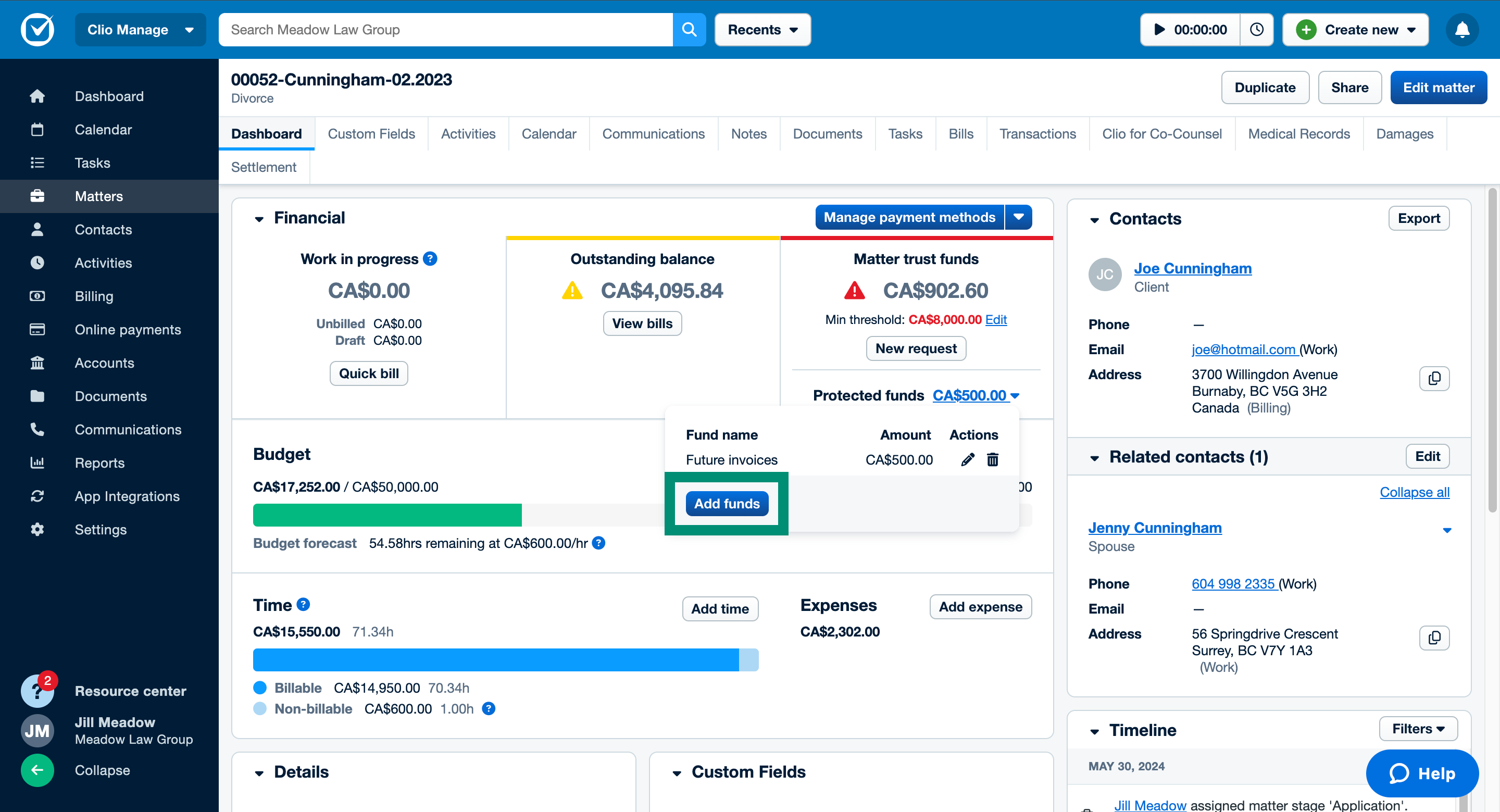

- Go to a matter.

- In the Dashboard subtab, open the Financial section and go to the Matter trust funds box.

- If this is the first time you are protecting funds for this matter, click Add next to Protected funds. If you already added protected funds to this matter, click the protected funds total and then click Add funds.

- Enter the amount that you want to protect and the reason for protecting the funds. If the client has multiple trust accounts, select the relevant account.

- Click Add.

- The amount of the trust funds that you protected will be subtracted from the total amount of available trust funds on the matter. You can view the protected funds by clicking the amount of the protected funds in the Matter trust funds box.

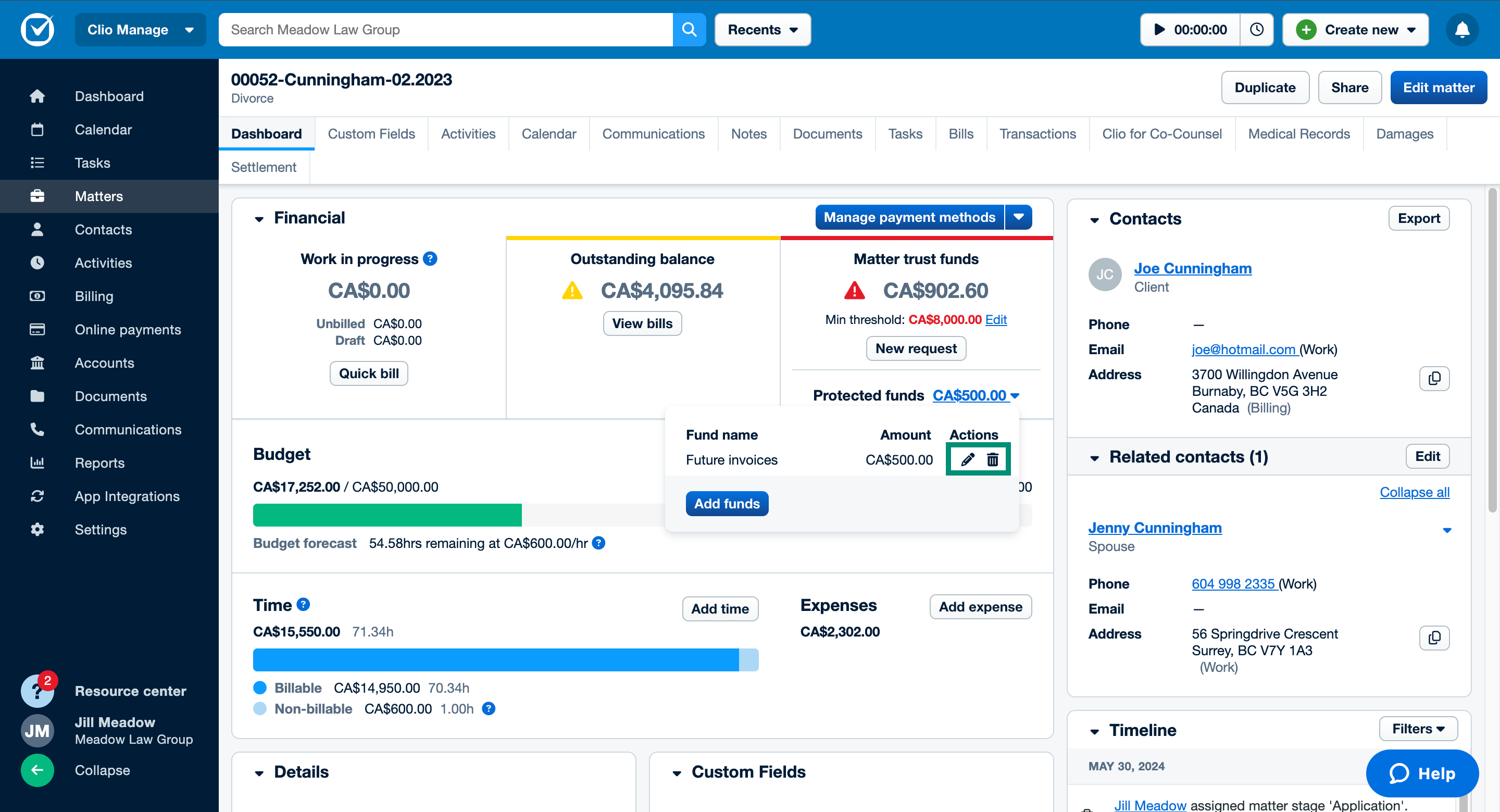

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Matter trust funds box, click the protected funds total next to Protected funds.

- Click the pencil icon representing Edit to edit a protected fund.

- Make any changes to the amount or reason and then click Save changes.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Matter trust funds box, click the protected funds total next to Protected funds.

- Click the trash can icon representing Delete to unprotect a fund.

- Click Delete to confirm.

- Go to the main Billing tab or the Bills subtab in a contact or matter.

- Find the invoice that you want to apply the protected funds to. You can use the quick filters to find invoices that have not been paid yet or the keyword search box.

- Click the down arrow next to Send and then select Apply protected funds.

- Select the account that the protected funds will go into and the protected fund that you want to use to pay the invoice.

- If the client has only one protected fund, the selection will be locked in and cannot be changed because there are no other protected funds.

- Click Apply funds.

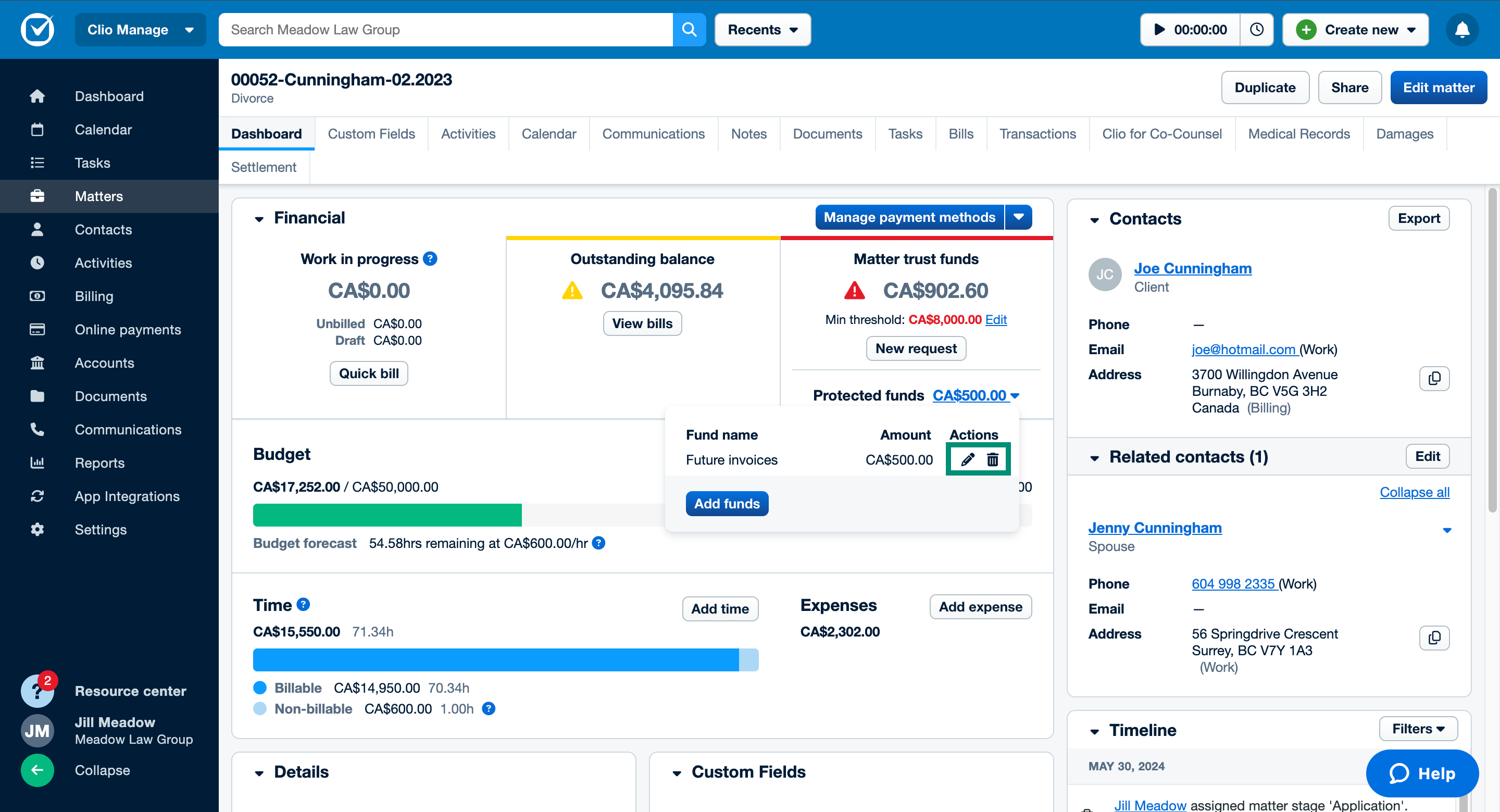

If you do not have Accounts permissions, you cannot add protected funds, but you can view all protected funds for a matter, and you can edit the reason for currently protected funds and increase the amount of the protected fund. Any changes made to protected funds will be recorded in the Matter Timeline. The record will show which user made the change with a date and time stamp.

You can also send a request to users who do have Accounts permissions to release protected funds back to the client or request that protected funds be used to pay an invoice. Once you send the request, all users with Accounts permissions will receive an email notification about the request.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Matter trust funds box, click the protected funds total next to Protected funds to view all protected funds for the matter.

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Matter trust funds box, click the protected funds total next to Protected funds.

- Click the pencil icon representing Edit to edit a protected fund.

- Increase the amount or change the reason and then click Save changes.

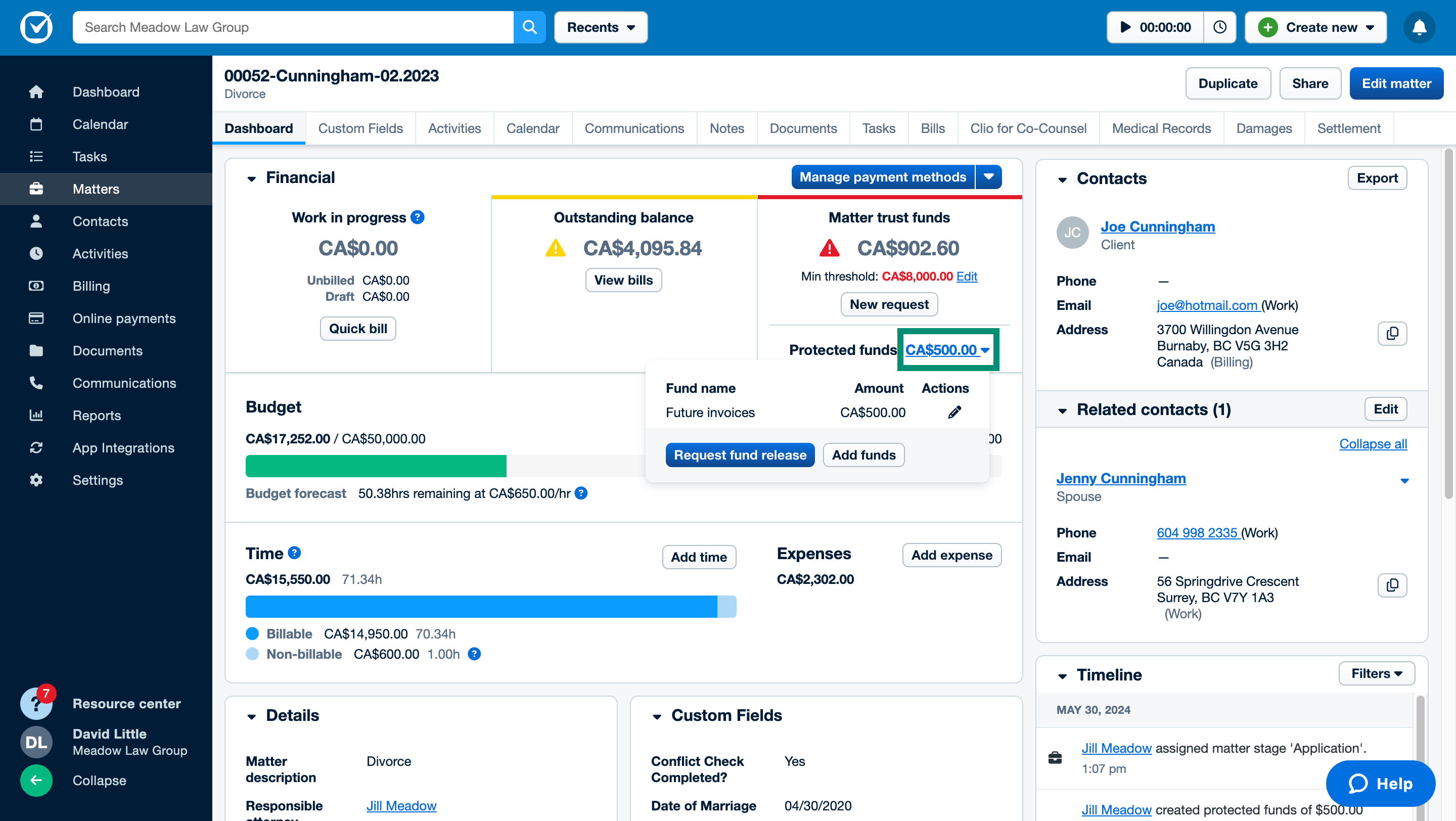

- Go to a matter.

- In the Dashboard subtab, open the Financial section.

- In the Matter trust funds box, click the protected funds total next to Protected funds.

- Click Request fund release.

- Select the protected fund and the reason for requesting the release.

- Under Reason, select Release back to the client or Pay an invoice. If you selected Pay an invoice, you will also need to select the invoice that should be paid.

- Optional: Enter a memo to add more details about the release request.

- Click Request fund release.

Sort and filter trust requests

Once a trust request is created, you can find it in the Billing tab or the Bills subtab within a matter or contact. The trust request is differentiated from normal bills when viewing the bill Id. The bill Id will have the word “Trust” written in parenthesis next to the bill Id number. To view only trust requests:

- Go to Billing.

- Select the All subtab.

- Click Filters.

- Optional: select the matter or contact.

- Under Type select Trust.

- Click Apply filters.

Edit trust requests

You can only edit a trust request if it is in draft and the trust approval process has not been skipped. Generated trust requests in draft have limited edit functionality compared to generated bills in draft. To edit a generated trust request:

- Go to Billing or the Bills tab in a contact or matter.

- Click the Draft subtab.

- Click Edit.

- Make your changes.

- Click Save trust request.

Approve trust requests

When a trust request is created and you do not check the box to skip the trust approval process, the trust request can be found in the Draft subtab in Billing. While in draft, you can edit the trust request and send it for approval and approve the trust request. Once approved, you can accept payment for the trust request.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Draft subtab.

- Click the down arrow next to Edit and select Submit for approval.

- Select the firm member(s) who need to approval the trust request.

- Click Submit for approval.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Pending approval subtab.

- Click the down arrow next to Edit and select Approve trust request.

Send trust requests

Once a trust request is approved, you can send it to the client. You can also send the trust request to other related contacts.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Unpaid subtab.

- Click Send.

- Select the trust bill template, make any changes, and select the send method. Learn more about sending bills and options in this article.

- Click Send trust request.

Delete trust requests

If a trust request is still in draft, you can still delete the request. A trust request that has been approved but does not have a recorded payment can only be voided.

- Go to Billing or the Bills tab in a contact or matter.

- Click the Draft subtab.

- Click the down arrow next to Edit and select Delete trust request. You can also view the trust request, click the More actions dropdown and select Delete.

- When the warning prompt appears, click Delete trust request.

Void trust requests

Follow these steps to void an approved and unpaid trust request:

- Go to Billing or the Bills tab in a contact or matter.

- Click the Pending approval subtab.

- Click the down arrow next to Edit and select Void trust request. You can also view the trust request, click the More actions dropdown and select Void.

- When the warning prompt appears, click Void trust request.

Record payments on trust requests

If you do not have Clio Payments enabled, or if your client does not want to pay by credit card online, you can record the payment as a direct payment in Clio. Due to regulations for trust fund management, you will be unable to edit or delete a payment recorded for a trust request.

Follow the steps below to record a trust request payment.

Important: You can only record payment for a multi-matter bill using contact-level trust funds. If the trust funds are associated with a matter, transfer the funds from the matter to the contact before recording payment on the bill.

- Go to Billing or the Bills tab in a contact or matter.

- Optional: Select the Unpaid subtab.

- Click the down arrow next to Send and click Record payment. You can also click Record payment in the upper right corner.

-

Select the payment source and select the client’s trust as the deposit account.

Note: If your client previously paid funds into a trust account, and those funds are not associated with a specific trust request, you can use those trust funds to record a payment to the current trust request by selecting the trust account from the Payment source dropdown. A table will show the amounts available in the selected trust account. -

Complete the remaining details.

Note: You can write off a remaining trust amount while recording a partial payment towards the trust request by first entering the partial amount, then checking the check box for Write offs. - Optional: In the Description field, you can enter information about the purpose of the transaction (e.g., "Payment for bill [bill number]", "Trust retainer for [name]"). Certain State Bars require this information in order to be compliant with trust accounting.

- Click Record payment.

Record new transactions

If you need to record a new trust transaction without creating a trust request, you can do so from within the transaction subtab of a contact or matter, or from the main Accounts tab.

- Go to the contact and click the Transactions subtab.

- Under Transactions, select the appropriate trust account that the funds are being deposited into.

- Click New transaction.

- Complete the remaining necessary fields.

- Source/Destination: Use this field to enter non-person information about the transaction (e.g., information about a bank account).

-

Payer/Payee: Use this field to specify if the person paying for a client's matter is the client themselves, or if the person receiving a payment related to a client's matter is the client themselves.

Note: Certain State Bars require this information in order to be compliant with trust accounting. - Type: Use this field to enter information about how the transaction is completed (e.g., cash payment or bank transfer).

- Description: Use this field to enter information about the purpose of the transaction (e.g., "Payment for bill [bill number]", "Trust retailer for [name]").

- Click Record transaction.

- Go to the matter and click the Transactions subtab.

- Under Transactions, select the appropriate trust account that the funds are being deposited into.

- Click New transaction.

- Complete the remaining necessary fields.

- Source/Destination: Use this field to enter non-person information about the transaction (e.g., information about a bank account).

-

Payer/Payee: Use this field to specify if the person paying for a client's matter is the client themselves, or if the person receiving a payment related to a client's matter is the client themselves.

Note: Certain State Bars require this information in order to be compliant with trust accounting. - Type: Use this field to enter information about how the transaction is completed (e.g., cash payment or bank transfer).

- Description: Use this field to enter information about the purpose of the transaction (e.g., "Payment for bill [bill number]", "Trust retailer for [name]").

- Complete the remaining necessary fields.

- Click Record transaction.

- Go to Accounts and select the appropriate trust account that the funds are being deposited into.

- Click New transaction.

- Complete the remaining necessary fields.

- Source/Destination: Use this field to enter non-person information about the transaction (e.g., information about a bank account).

-

Payer/Payee: Use this field to specify if the person paying for a client's matter is the client themselves, or if the person receiving a payment related to a client's matter is the client themselves.

Note: Certain State Bars require this information in order to be compliant with trust accounting. - Type: Use this field to enter information about how the transaction is completed (e.g., cash payment or bank transfer).

- Description: Use this field to enter information about the purpose of the transaction (e.g., "Payment for bill [bill number]", "Trust retailer" for [name]).

- Click Record transaction.

Record trust account interest earned or bank charge

In Clio Manage, follow these steps to record interest earned on funds held in trust or bank charges for a trust account.

- In Clio Manage, go to Accounts.

- Select the relevant trust account.

- Click New transaction.

- In the Amount field, enter the interest earned.

- Match the Date field to the date of the interest earned.

- Select the radio button for Trust interest.

- Optional: In the Description field, enter information about the purpose of the transaction (e.g., "Interest on trust account").

- Click Record transaction.

- In Clio Manage, go to Accounts.

- Select the relevant trust account.

- Click New transaction.

- In the Amount field, enter the bank charge as a negative amount.

- Match the Date field to the date of the bank charge.

- Select the radio button for Bank charge.

- Optional: In the Description field, enter information about the purpose of the transaction (e.g., "Bank charge on trust account").

- Click Record transaction.

Transfer trust funds

If you store trust funds at the client level, they can be applied as payment on bills for any of the client's matters. When these funds are recorded, a transaction is added to the client ledger, which can be found in the Transactions subtab of the contact card. You can pay bills with the matter-level trust funds from the Matter Balance on that specific matter only. When these funds are recorded, a transaction is added to both the client and matter ledgers, which can be found in the Transactions subtab of the contact card or matter screen.

- Go to the Transactions subtab of a contact.

- Select the client account where funds are stored.

- Click Transfer funds.

- Select Between matters.

- Under Source, select Client Balance.

- Under Destination, select a matter.

- Complete the remaining fund transfer details.

- Record transfer.

- Go to the Transactions subtab of a matter.

- Select the client account where funds are stored.

- Click Transfer funds.

- Select Between matters.

- Under Source, select a matter with a Matter Balance.

- Under Destination, select Client Balance.

- Complete the remaining fund transfer details.

- Click Record transfer.

Refund trust funds

If you are an administrator or your account's primary subscriber, or if you have both accounts and billing permissions, and you need to return any remaining trust funds back to your client or adjust mistakenly applied trust funds, you can return these funds directly from Clio Payments back to your client's original payment method. You can refund all trust payments paid by eCheck (US only) within 180 days. There is no limit for trust payments paid by credit card.

When issuing a refund, you cannot refund more than the amount that was initially charged for the trust request for each matter. Once the refund is successfully processed, both you and your client will receive a confirmation email.

Important: Most jurisdictions require contemporaneous recording of trust disbursements. Ensure you record the Payee and Description immediately to maintain an audit-ready trust ledger.

Note: If you deleted the matter before returning any remaining trust funds, you will need to recover the matter from the Recovery bin first. Learn more here.

- Go to Online payments.

- Click Refund next to the trust payment transaction.

- Under Refund amount, enter the amount that you want to return to the client.

- This modal will show the amount available to refund to the client, the account from which the refund is coming, and the client to whom it is going.

- Simple payments without any linked contact or matter will not show the contact or matter, and the refunded transaction will appear only in the Online payments tab.

- Payments linked to a contact or matter will show the contact or matter, including payments for multi-matter trust requests. Refunded transactions show in the Transaction subtab of the contact and matter, and the main Online payments tab.

- For multi-matter trust requests, the refund will be applied from the newest created matter to the oldest created matter. Additionally, the refundable amount available for each matter depends on the original trust request payment amount for that matter.

- Click Refund payment.

- Once refunded, the transaction will remain in the Paid quick filter in the bills table. You can also view all transactions for the trust account in the contact, the Transaction subtab of the matter, or the trust account in the main Accounts tab.

- Go to Billing or the Bill subtab in the contact or matter.

- Optional: Select the Paid quick filter to view paid trust requests.

- Click the trust request Id number.

- Once in the trust request preview window, select the Online payments subtab.

- Click Refund next to the trust payment transaction.

- Under Refund amount, enter the amount that you want to return to the client.

- This modal will show the amount available to refund to the client, the account from which the refund is coming, and the client to whom it is going.

- Simple payments without any linked contact or matter will not show the contact or matter, and the refunded transaction will appear only in the Online payments tab.

- Payments linked to a contact or matter will show the contact or matter, including payments for multi-matter trust requests. Refunded transactions show in the Transaction subtab of the contact and matter, and the main Online payments tab.

- For multi-matter trust requests, the refund will be applied from the newest created matter to the oldest created matter. Additionally, the refundable amount available for each matter depends on the original trust request payment amount for that matter.

- Click Refund payment.

- Once refunded, the transaction will remain in the Paid quick filter in the bills table. You can also view all transactions for the trust account in the contact, the Transaction subtab of the matter, or the trust account in the main Accounts tab.

Disburse trust funds

If you are holding settled funds in a client's trust account and your client needs to pay other entities, such as medical providers or insurance companies, you can record a transaction and issue funds out of the trust account using the disburse funds functionality.

Note: It is important to choose the correct method for removing funds. Use Refund to electronically return funds through Clio Payments. Use Disburse to manually record funds leaving the account via physical check or cash, ensuring your Clio records match your bank activity.

Tip: Clio Payments customers who need to return trust funds to a client can do so using the refund trust funds feature. Returning funds allows you to refund the trust funds back to your client's credit card (US and Canada) or eCheck account (US only) without having to manually issue a check. Learn more about refunding trust funds here.

- Go to the contact or matter where the trust funds are stored, and select the Transactions subtab.

- In the Transactions table window, use the down arrow to select the client's trust account.

- Click Disburse funds.

- Enter the amount that you are disbursing to the vendor and complete the remaining fields.

- Destination: Use this field to enter non-person information about the transaction (e.g., information about a bank account).

- Payee: Use this field to specify who is receiving the funds.

- Payment method: Use this field to enter information about how the transaction is completed (e.g., cash payment or bank transfer).

- Description: Use this field to enter information about the purpose of the transaction (e.g., "Interest on trust account").

- Click Record transaction.

- The contact or matter's trust balance will adjust according to the amount disbursed.